Star Mortgage

(for non-permanent residents)

This mortgage can be used by customers who are foreign nationals without permanent resident status.

Star Mortgage Eligibility

- *If you receive a permanent residence permit during the loan period and contact TSB, you may be eligible for a preferential interest rate on your loan after a predetermined screening.

Annual income (incl. tax) of at least JPY 4 MM

- *Corporate officers or self-employed persons can apply if they have operated in Japan for at least three financial years.

- *Your requests may not be granted depending on the screening results.

- *Please refer to the product description for details.

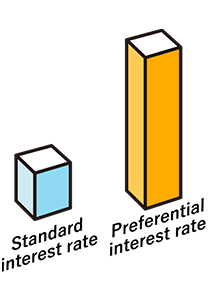

Reduced lifetime interest rate if designated as salary deposit account!

In principle, if you use your Star Mortgage repayment account as your salary deposit account, the interest rate on your Star Mortgage will be reduced by 1.10% for the lifetime of the loan.

From Star One mortgage base rate at the time of borrowing ▲1.10%

to

to

per year

per year

(As of  )

)

- *The borrowing interest rate will be determined and applied to those who meet the prescribed screening criteria.

- *If you receive a permanent residence permit during the loan period and contact TSB, you may be eligible for a preferential interest rate on your loan after a predetermined screening.

- *Additional 0.3% per year will be added to the above interest rate depending on the details of the group credit life insurance plan. Please check Loan Interest Rate for details.

- *An administration fee of 2.2% (including tax) of the loan amount will be charged on the loan drawdown date (per loan). There will also be other expenses, such as a registration fee and stamp tax (actual cost).

The following insured plans are available for Star Mortgages!

Group credit insurance

In addition to coverage for death and severe disability and living needs, two other coverage plans provide peace of mind!

-

1Hospitalization expense coverage: JPY 100,000 per hospitalization (day patient expenses also covered)

If a customer is hospitalized due to illness or injury, hospitalization expense insurance will be paid (up to a total of 12 times) -

2Short-term disability coverage: Guarantees the amount of repayment if you are hospitalized on the repayment date

If a customer is hospitalized for illness or injury and the hospitalization continues until the loan repayment date, an insurance benefit will be paid (up to 6 months per hospitalization, up to a maximum of 36 months in total over the loan period).

Cancer protection rider

(0.3% increase in interest rate)

If you are diagnosed with cancer, your loan balance becomes “zero”

If you are diagnosed with cancer for the first time in your life and the diagnosis is confirmed by a doctor, a substantial amount will be paid to Tokyo Star Bank as a diagnosis benefit, which will be used to repay the loan. This helps to alleviate your financial concerns during treatment.

Wide group credit

(0.3% increase in interest rate)

Do not give up on insurance even with pre-existing conditions

This group credit life insurance has more relaxed underwriting conditions than conventional group credit life insurance.

Hospitalization expense coverage, short-term disability coverage, and cancer coverage riders cannot be attached.

An underwriting review prescribed by the insurance company is required before enrollment. Not all are eligible to enroll.

- *There are restrictions on the payment of insurance claims, diagnosis benefits, etc., such as that intraepithelial neoplasms (intraepithelial cancer) are not eligible for the payment of cancer diagnosis benefits. Before applying, please be sure to read the “Agreement Overview” and “Cautionary Information” in the insured's booklet for details of coverage, such as reasons for payment of insurance claims and diagnosis benefits, and cases in which payment is not made.

Loan Period and Limit for Star Mortgages

- Loan period

-

1 year or more to 35 years

(in 1-year increments)

- Loan amount

-

JPY 5 MM to JPY 100 MM

(in JPY 100,000 increments)

However, if the use of the funds is for [purchase or construction], the maximum loan amount will be limited to the purchase price of the property.

- *Other restrictions may apply based on annual income, collateral assessment by TSB, and other factors.

- *Weekdays 9:00-19:00

Star Mortgage Application Process

| People who can use this product |

|

|---|---|

| Usage of funds |

[Purchase or construction]

[Refinancing]

|

| Loan amount |

Loans from 5 million yen up to 100 million yen (units of 100,000 yen) are available. |

| Loan period |

The loan period is from 1 year to 35 years (units of 1 year). |

| Repayment holiday |

The repayment amount can be reduced for a maximum of 36 months at any time from the second year since repayment started. Repayment holidays cannot be used when payments are in arrears.

|

| Repayment method |

The repayment method is equal monthly payments with interest. A bonus repayment can also be made every six months for up to 40% of the loan amount.

|

| Loan interest rates |

|

| Collateral | A mortgage will be established over the land and building of the residence covered by the loan with our bank as the first priority lien. |

| Guarantor | In principle, guarantees from guarantee companies or third parties are not required. However, if you have a spouse, please arrange for them to be a jointly liable or to be a guarantor jointly and severally liable . In cases where income is calculated on a combined basis or co-owned property is provided as collateral, it will be necessary for said joint and several guarantor be the person whose co-income is combined with yours or who has co-ownership of the property, as the case may be. |

| Prepayment | No fee is required for the procedures for partial prepayment and full prepayment. The procedures can be implemented via Tokyo Star Direct (Internet Banking). |

| Administrative fee (tax included) |

An administrative fee of 2.2% of the loan amount shall be paid on the loan disbursement date (for each loan).

|

| Group credit life insurance |

In case of emergency, we require that you enroll in a plan with the insurance company group credit life insurance offered by the insurance company as arranged by our Bank. In the event that you use 2 the plan consisting of credit life insurance with cancer coverage and the employment incapacity credit cost insurance rider or 3 the wide group credit plan (group credit life insurance with expanded coverage conditions), the interest rate will increase by 0.3%.

|

| Designated dispute resolution body for contracts with our bank | Japanese Bankers Association Inquiries Japanese Bankers Association Consultation Office Telephone number 0570-017109 or 03-5252-3772 |

Frequently Asked Questions about Star Mortgages

In principle, guarantees by a guarantee company or third party are not required.

However, if you have a spouse, your spouse must be a joint borrower or joint guarantor.

In addition, when combining incomes or using a co-owned property as collateral, it is necessary to have the joint income earners or co-owner of the property become joint guarantors or joint borrowers

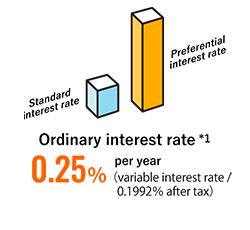

For the Star One account (comprehensive transaction account) that you open when you sign up for a loan, the interest rate on the JPY savings account is

0.25% (0.1992% after tax) when you designate it as your salary deposit account *1

In addition, there are effectively no bank transfer fees for up to

5 times a month when using internet banking *4 ...and more

Interest rate as of

Tokyo Star Bank

Tokyo Star Bank is a subsidiary of CTBC Bank Co., Ltd. (CTBC Bank), one of the largest private financial institutions in Taiwan

Our relationship with CTBC Bank helps us meet the diverse needs of our customers.

Our shareholder, CTBC Bank (official name: CTBC Bank Co., Ltd.), is Taiwan's largest private bank and the primary subsidiary of CTBC Financial Holding, a major financial group in Taiwan. Operating globally through its worldwide network, Tokyo Star Bank continues to achieve tremendous growth.

- *Weekdays 9:00-19:00